Business Insurance in and around Dallas

Get your Dallas business covered, right here!

Helping insure small businesses since 1935

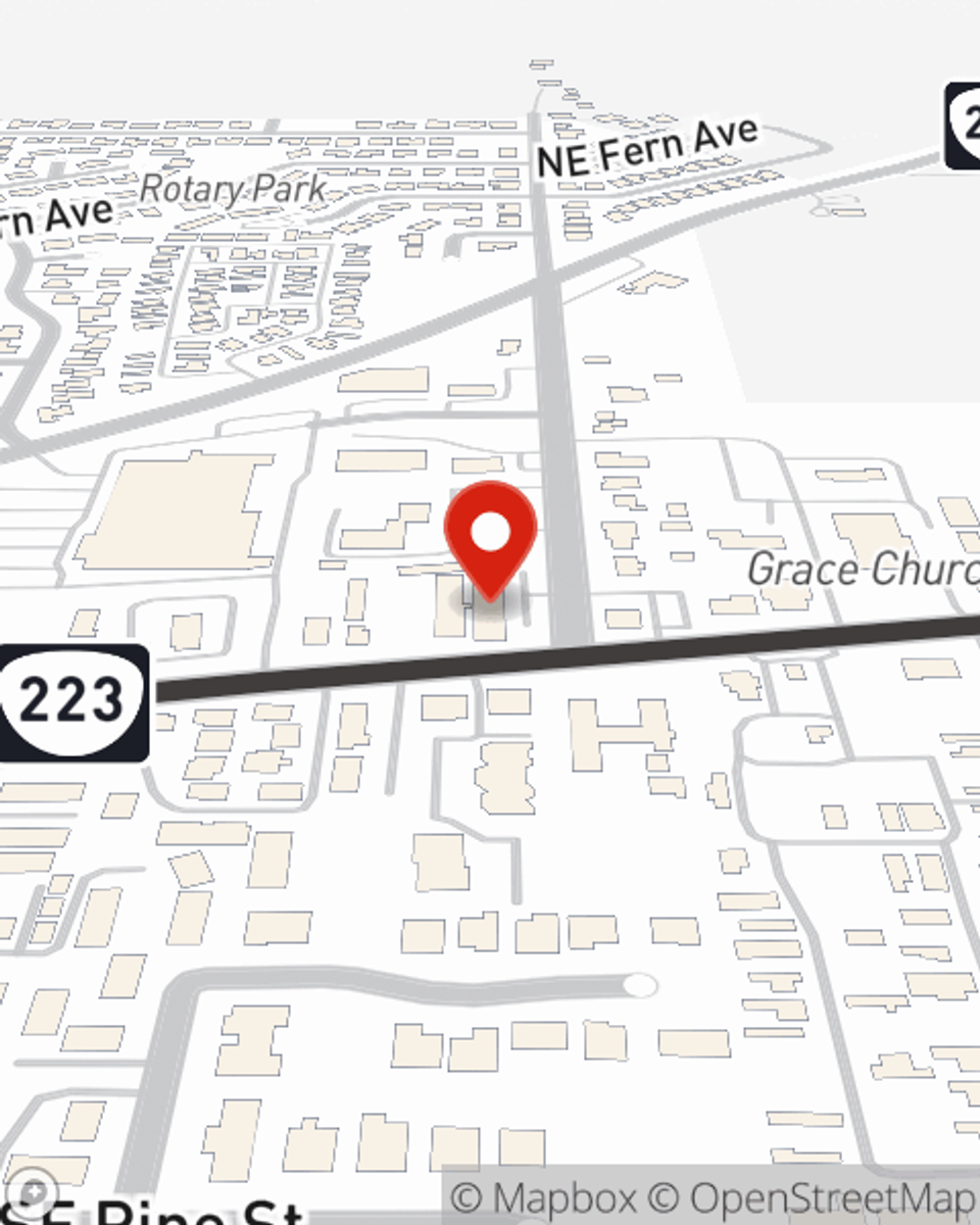

- Salem

- Monmouth

- Amity

- Polk County

- Independence

- Marion County

- Lincoln County

- Yamhill County

- Rickreall

- Falls City

- Sheridan

- Willamina

- Grand Ronde

Insure The Business You've Built.

As a business owner, you have to think about all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Mitch Ratzlaff. Mitch Ratzlaff understands where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

Get your Dallas business covered, right here!

Helping insure small businesses since 1935

Surprisingly Great Insurance

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have relied upon State Farm for coverage from countless industries. It doesn't matter if you are a taxidermist or a sporting goods store or you own a book store or a dental lab. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Mitch Ratzlaff. Mitch Ratzlaff is the person who understands where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to familiarize yourself about your small business insurance options

Call or email the exceptional team at agent Mitch Ratzlaff's office to discover the options that may be right for you and your small business.

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Mitch Ratzlaff

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.